Explore expert price predictions

The Future Price of Bitcoin

Bitcoin's Epic Rise Surprised Everyone

"It might make sense just to get some in case it catches on." Satoshi Nakamoto (2009)

Reflecting on Bitcoin's Price History

Looking back at Bitcoin's price history can bring up some strong feelings. When Bitcoin first came out, its price was only a few cents or dollars. Who would have guessed it would one day be worth tens of thousands of dollars and might even reach six figures? In those early days, many people doubted it would ever be worth as much as one dollar. The idea of it reaching $100 or $10,000 seemed like a dream.

People who bought Bitcoin back then and sold it or lost their coins would be millionaires today. It's easy to think now, "I should have bought more," but even the most hopeful people back then didn't expect such a fast and steady rise. At that time, buying and keeping Bitcoin was hard because there weren't many exchanges and secure ways to store it. This look back shows just how surprising and unpredictable Bitcoin's journey has been.

If You Didn't Buy Bitcoin Earlier, Today Might Be the Best Day

This saying, often shared on social media, seems to be good advice in hindsight. Even though Bitcoin's price goes up and down a lot, it's higher today than ever before. However, an asset that has risen so much can also fall. Some people hesitate to buy when the price is high, while others think it will keep going up.

Opinions on Bitcoin are very divided. Some say it has no real value and is just digital numbers. Others say it has value because it’s based on math, is decentralized, and no one can shut it down. Bitcoin has improved many lives, but its volatility makes many people wary. They don't realize that despite the ups and downs, Bitcoin has shown a clear upward trend over time.

How High Can Bitcoin's Price Go in the Future?

Predicting Bitcoin's long-term price is challenging due to numerous influencing factors from different angles. Unlike gold, which can have flexible inflation based on its price, Bitcoin's inflation rate is fixed in its code, with only 21 million Bitcoins ever to be mined. This limited supply is a key factor in its potential for future price increases.

Additionally, Bitcoin operates in a decentralized manner, free from government control, appealing to many as a safeguard against traditional financial systems. If fiat currencies face instability or collapse, people might seek a safe haven in Bitcoin, significantly boosting its demand and price.

Currently, we see growing adoption by countries and companies, adding to its credibility and potential value. Given the complexity of these factors, it's worth closely examining possible price predictions through technical chart analysis and opinions from experts in the space.

Bitcoin Fusion Forecast

Combining various prediction models into one 10-year chart

Bitcoin24 (base model) by Michael Saylor,

Power Law by @Giovann35084111,

Rainbow Chart (projected) by @rohmeo_de,

Stock-To-Flow by @100trillionUSDby , and

Stock-To-Income by @_digitalik_.

Further explanations of the different models are provided here: Forecast Models

Bitcoin Long-Term Price Predictions

Interactive Chart Showcasing Expert Opinions and Forecast Models

Price Forecast Models Explained

A breakdown of the most popular Bitcoin price prediction models in simple terms

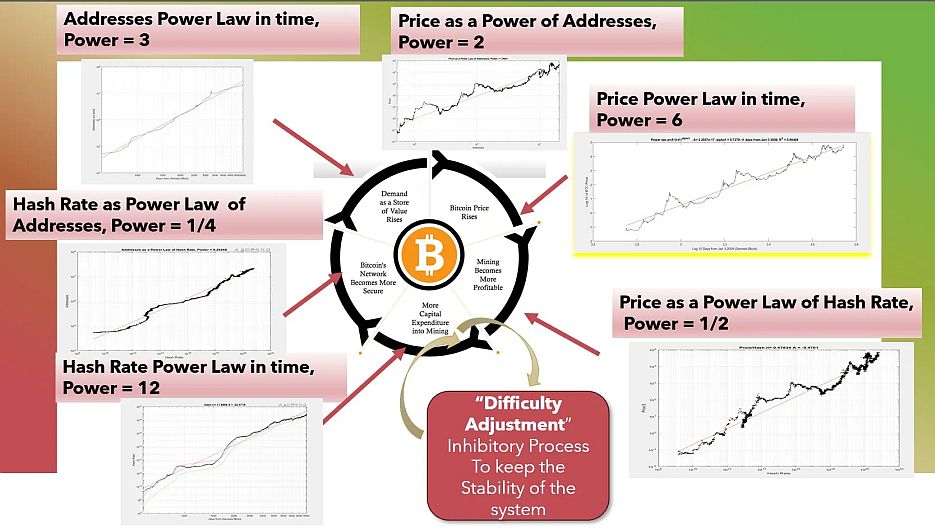

Power Law analyzes Bitcoin’s price over logarithmic scales to project trends. [@Giovann35084111].

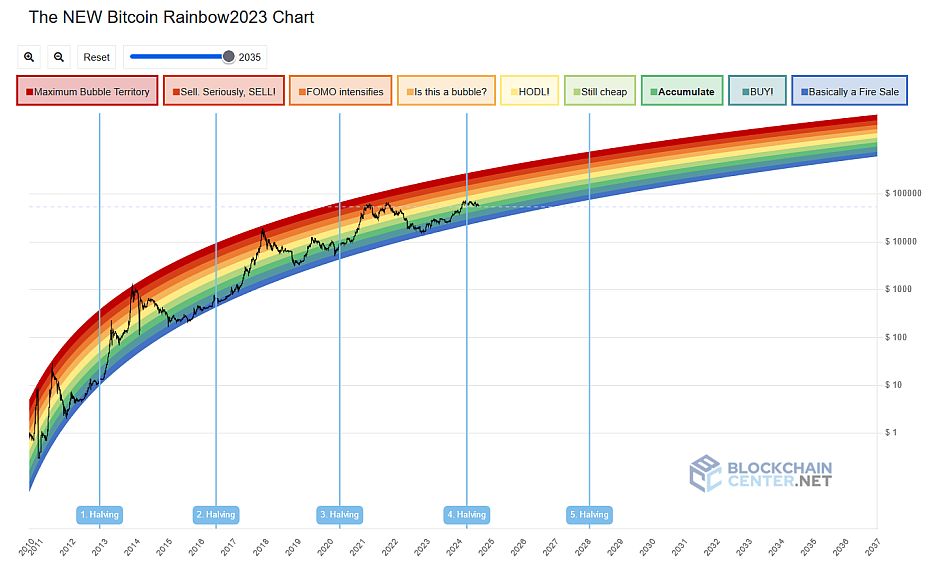

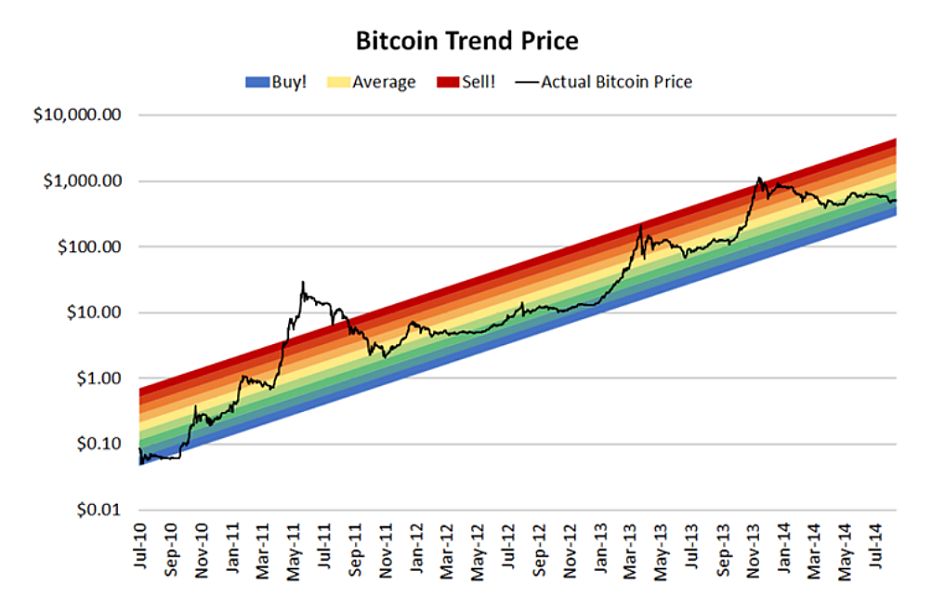

Rainbow Chart maps Bitcoin's price to colored bands reflecting market sentiment. [@rohmeo_de].

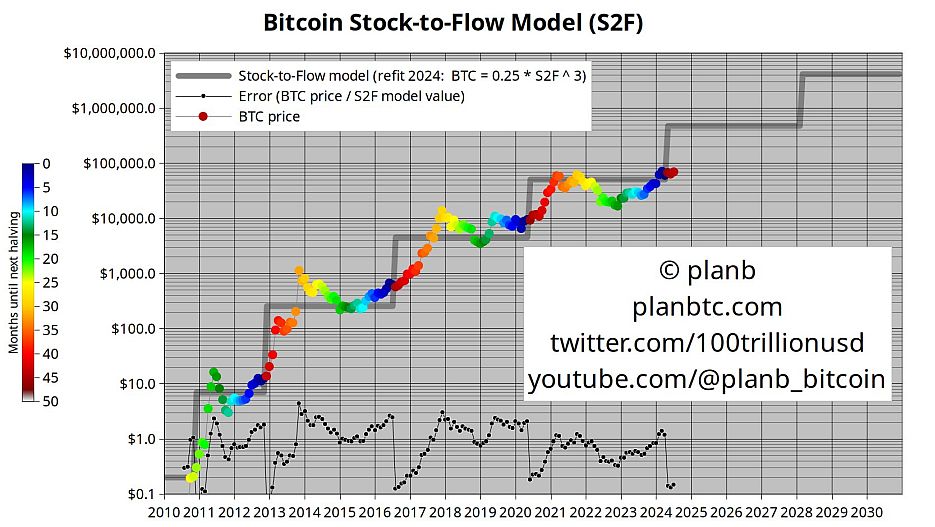

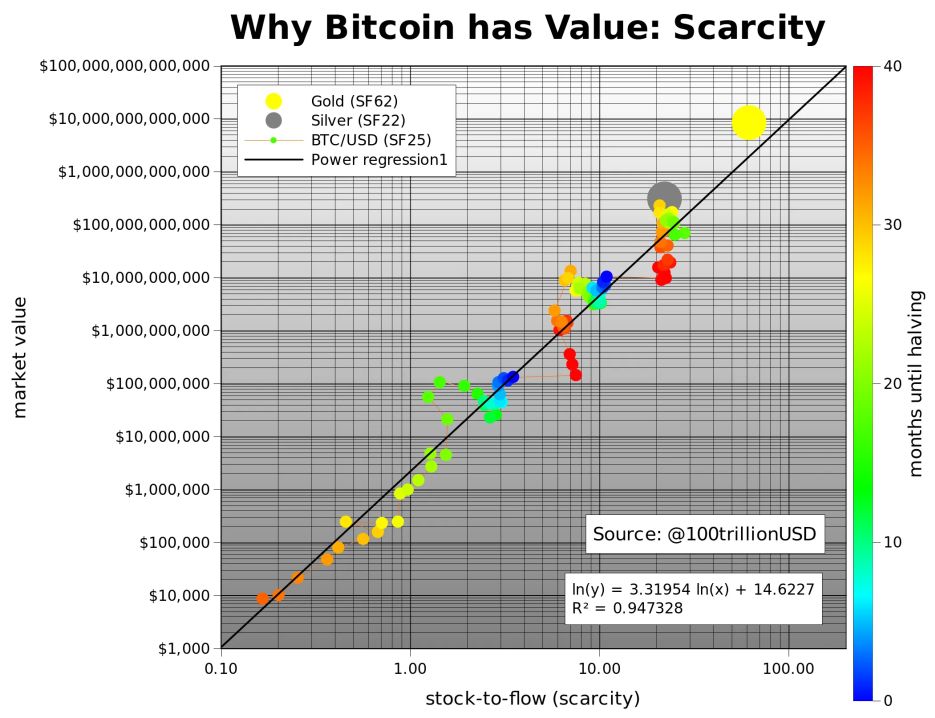

Stock-to-Flow model predicts Bitcoin’s future price based on its increasing scarcity, similar to commodities like gold. [@100trillionUSD].

Stock-to-Income model refines Stock-to-Flow by incorporating Bitcoin’s production costs. [@_digitalik_].

Bitcoin24

"Bitcoin24 is an open-source macro model forecasting asset growth and #Bitcoin adoption over the next 21 years, along with micro models to evaluate various Bitcoin strategies for individuals, corporations, institutions, and nation-states". [Tweet by Michael Saylor]

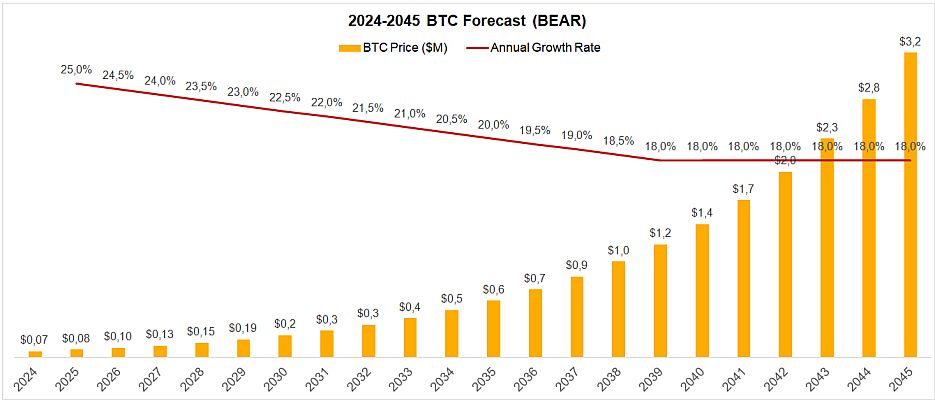

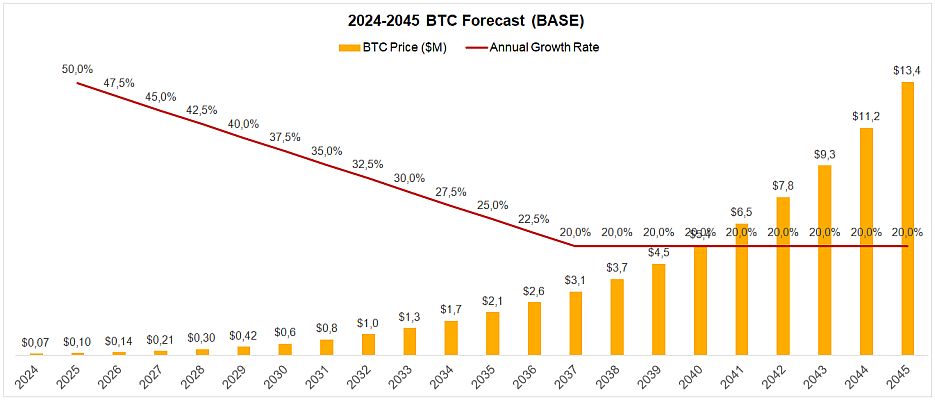

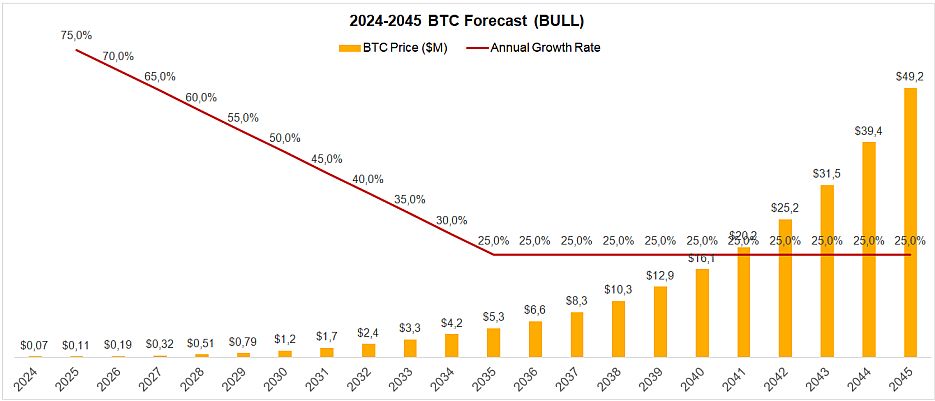

The Bitcoin24 price prediction model, proposed by Michael Saylor in August 2024, brings a fresh perspective to forecasting Bitcoin’s future price, using a set of four forward-looking parameters. These parameters — growth rate, decrease in growth rate, final rate, and initial fair value (scale) — shape the model’s predictions and allow for flexible adjustments. Saylor's model offers three distinct scenarios: bear, base, and bull.

The growth rate in the model represents how quickly Bitcoin’s adoption or value will rise. A higher growth rate points to rapid and widespread adoption, while a lower growth rate suggests slower growth and more cautious adoption. In the bear case, Bitcoin’s price is projected to reach $250,000 by 2030, while the base case, with more moderate growth, predicts a rise to $500,000. In the most optimistic bull case, Bitcoin is expected to soar to $1,000,000 by 2030.

The decrease in growth rate accounts for the eventual slowdown in Bitcoin’s adoption as it matures. While initial growth may be fast, the model predicts that growth will slow over time. In the bear case, this deceleration is more pronounced, while the bull case assumes a more extended period of rapid growth before the slowdown.

The final rate is the long-term annual growth rate Bitcoin is expected to stabilize at once it reaches full global adoption. In the bear case, this leads to a relatively conservative price, while the bull case envisions a much higher final rate.

Lastly, the scale (initial fair value) parameter sets the starting point for Bitcoin’s value. This baseline price, combined with the other parameters, shapes the model’s overall predictions.

Saylor provides stakeholders with an excel sheet, allowing for customized scenarios based on different assumptions. [Excel] [Video]

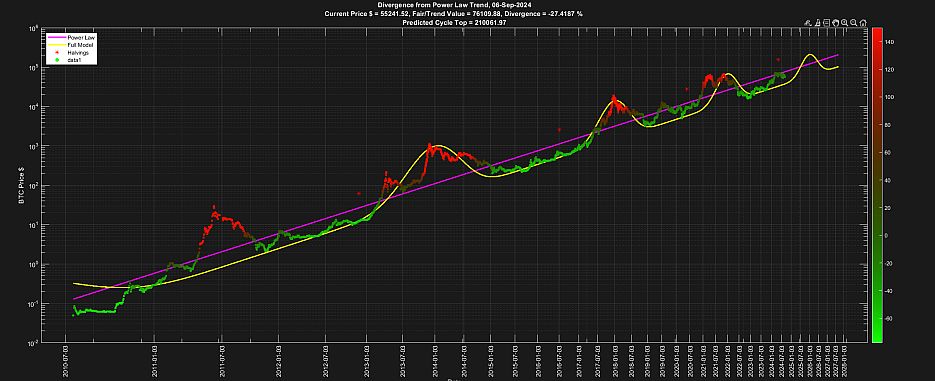

Power Law

The Bitcoin Power Law model, created by Giovanni Santostasi, suggests that Bitcoin's price grows in a predictable way over time. According to this model, the price is proportional to the number of days since Bitcoin’s first block, raised to the power of 5.8. This means Bitcoin’s price increases at a slowing pace, but steadily over time.

When plotted on a log-log chart (where both axes use logarithms), Bitcoin’s price growth appears as a straight line. This differs from charts that only use a logarithmic scale for the price, which show the growth curve bending over time. The log-log approach highlights the long-term, consistent relationship between time and price.

The model has a high R-squared value, usually above 0.95, meaning it closely matches Bitcoin’s historical data. Based on this model, predictions suggest Bitcoin could reach $210,000 by 2026, $10 million by 2045, and surpass gold’s market cap by 2033. [BitPoseidon] [@Giovann35084111] [Chart].

Rainbow Chart

The Rainbow Chart was never intended to be a serious tool for predicting Bitcoin's future price. It was originally created as a fun, visual way to look back at Bitcoin's price history—a kind of meme that turned out to be surprisingly insightful, since its 2014 formula still aligns with today’s trends.

The chart displays different color bands to suggest whether Bitcoin might be underpriced or in a bubble. It uses a logarithmic regression model, which helps smooth out the volatile price movements and shows a clearer long-term trend. In this context, regression is a statistical method used to fit a curve to the price data over time, helping to reveal the overall trend despite short-term fluctuations. This model extends to 2036, where Bitcoin’s price is projected to be between $750,000 and $4.5 million.

At one point, in early 2021, Bitcoin’s price left the boundaries of the Rainbow Chart, and many declared the model "dead." However, a newer version (v2) was released in 2022 with an updated and more conservative regression model that better reflects Bitcoin's behavior. Though not a precise prediction tool, the chart can help long-term investors gauge potential moments to buy or sell. [Blockchaincenter]

Stock-to-Flow (S2F)

The Stock-to-Flow (S2F) model was introduced by PlanB, a former institutional investor. It is a method used to quantify the scarcity of an asset and predict its future value. The model calculates the stock (the total existing supply of an asset) and divides it by the flow (the new supply created each year). PlanB applied this model to Bitcoin, which, like gold and silver, has a capped supply, making it a "hard" asset.

The S2F model demonstrated that Bitcoin's increasing scarcity over time could be used to estimate its value, particularly around events like the halving, which cuts the new supply in half approximately every four years. With each halving, Bitcoin’s stock-to-flow ratio increases, signaling higher scarcity. The model suggests that Bitcoin could reach a price level of $500,000 between 2025 and 2027. Further out, between 2028 and 2030, Bitcoin could reach a price of $4 million.

PlanB has released various versions of the Stock-to-Flow model, each with specific contexts and different assumptions, leading to different price forecasts. However, many people still use these models incorrectly, applying them in contexts they were not designed for. Additionally, some analysts have developed their own versions of the S2F model with different data, but often still refer to PlanB's original work, causing confusion. [Video] [PlanB] [Chart]

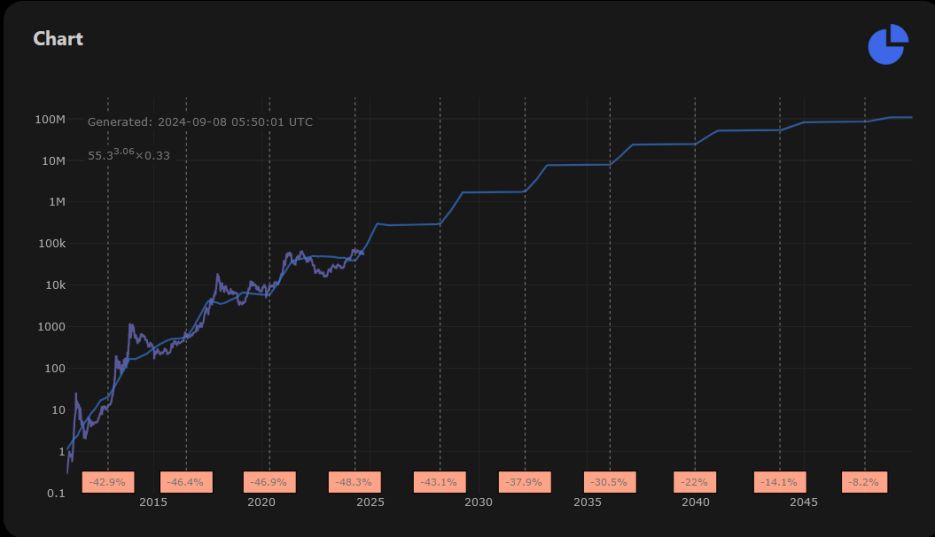

Stock-to-Income (S2I)

The Stock to Income model compares the total stock of Bitcoin to the total income miners generate, which consists of both the mining rewards (subsidy) and transaction fees. Unlike the Stock-to-Flow model, which focuses solely on Bitcoin’s scarcity based on supply and annual production, Stock to Income takes into account the economic incentives for miners. As block rewards diminish with Bitcoin’s halving cycles, transaction fees will play an increasingly significant role in miner compensation.

To provide a more accurate reflection, this model uses a 365-day moving average to calculate the average daily subsidy and fees. For future predictions, it assumes transaction fees will remain constant based on the previous year's average. The "stock" in this model is defined as the number of active Bitcoins over the last ten years, excluding coins that are considered lost due to forgotten keys or early-value negligence. This adjustment provides a clearer picture of the actual Bitcoin supply in circulation.

The Stock to Income model recalculates every five minutes to ensure up-to-date accuracy. While Stock-to-Flow centers around Bitcoin’s scarcity, Stock to Income provides insights into the sustainability of mining as a long-term business model. [stocktoincome.com] [@_digitalik_]

Popular Bitcoin Price Predictions

Insights from Experts and Media on Bitcoin's Future Price Predictions

2024

27 July 2024 | Bitcoin Price: $$67,920

Michael Saylor Predicts Bitcoin Price at $13 Million by 2045

In late July 2024, Michael Saylor introduced his Bitcoin24 price prediction model, providing long-term forecasts until 2045. The model outlines three scenarios: in the bear case, Bitcoin is predicted to reach $3 million, the base case projects $13 million, and the bull case expects Bitcoin to soar to $49 million. These projections vary based on differing rates of adoption and growth assumptions.

For shorter-term predictions by 2030, the model estimates Bitcoin will hit $250,000 in the bear case, $500,000 in the base case, and $1 million in the bull case. These projections offer a glimpse of Bitcoin’s potential trajectory within the next decade, based on different adoption speeds.

In August 2024, Saylor released the Bitcoin24 model as a public Excel sheet, allowing users to customize the model’s assumptions. Stakeholders can adjust key parameters, including the growth rate, decrease in growth rate, final rate, and initial fair value, to generate personalized forecasts based on their expectations. These variables are essential to understanding the flexibility and accuracy of the model as it adapts to different future conditions. [Bitcoin24 prediction model] [Tweet by Michael Saylor]

14 May 2024 | Bitcoin Price: $63,000

Ric Edelman Predicts Bitcoin Price at $420,000 by end of 2030

Ric Edelman projects Bitcoin’s value could reach $420,000 by the end of the decade, driven by its unique supply-demand dynamics. With Bitcoin’s supply capped at 21 million, Edelman highlights that even a small shift in investor allocation—just 1% of global financial assets valued at $738 trillion—could funnel $7.4 trillion into Bitcoin.

Dividing this demand among the 19.4 million existing Bitcoins would raise its price by $378,000, adding to its current value and achieving the $420,000 mark. This calculation emphasizes Bitcoin’s potential as a key asset in diversified portfolios.

Edelman also points to the increasing adoption of Bitcoin and blockchain technology by institutions, as well as the introduction of spot Bitcoin ETFs, as catalysts for its growth. Investors are encouraged to consider these factors when making long-term financial decisions. [Ric Edelmann]

5 January 2024 | Bitcoin Price: $44,113

Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

In this Forbes article from January 2024, Bitcoin is depicted as experiencing a noteworthy recovery, starting the year at $45,203, a rebound from its 65% value drop in the previous year due to various market upheavals like the Terra Luna crash and FTX fall. Looking ahead, 2024 is significant for Bitcoin, especially with the anticipated Bitcoin halving event, which historically signals a bullish trend by reducing the supply of new coins. However, the future of Bitcoin remains shrouded in uncertainty, heavily influenced by global economic factors and regulatory shifts. Despite these challenges, some experts in the Forbes article remain optimistic, predicting potential growth for Bitcoin, with projections ranging from $60,000 by the end of 2024 to an ambitious $1,000,000 by 2025. These predictions are partly bolstered by the increased accumulation of Bitcoin by major investors and the positive impact of previous halving events on Bitcoin's price. Nonetheless, the inherent volatility of the crypto market, compounded by external factors such as government regulations and global economic conditions, renders Bitcoin's future price highly unpredictable. [Forbes: Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?]

2023

14 May 2023 | Bitcoin Price: $26,911

What's the Future of Bitcoin?

In a comprehensive analysis by The Motley Fool, Bitcoin's future is examined through various lenses, spanning optimistic, pessimistic, and realistic scenarios. The optimistic view envisions a world where Bitcoin is universally adopted as a standard payment method, supported by favorable government policies, breakthroughs in technology, significant institutional investments, and its pivotal role in the expanding decentralized finance (DeFi) sector.

On the flip side, the pessimistic scenario depicts Bitcoin's complete downfall due to global governmental bans, emergence of superior digital currencies, catastrophic technological flaws, and environmental sustainability issues. Shifting to a more balanced perspective, the article acknowledges the ongoing uncertainties surrounding regulatory policies and the gradual, yet uneven, adoption of Bitcoin and other digital currencies. It highlights the intense competition Bitcoin faces from other cryptocurrencies, which may offer faster transactions, lower fees, and better privacy features. Future technical enhancements to the Bitcoin network are anticipated, though these improvements are expected to be incremental and contentious within the community. Persistent price volatility is likely to continue characterizing Bitcoin's market behavior.

In the long-term view, the article posits that cryptocurrencies like Bitcoin could eventually assimilate into the mainstream financial landscape, similar to stocks or bonds, under a well-established legal and regulatory environment. However, this future remains uncertain and demands ongoing vigilance and adaptability. As an investment, Bitcoin is described as a high-risk, high-reward venture, potentially fitting for diversified portfolios but requiring cautious approach due to its pronounced volatility. [The Motley Fool: What's the Future of Bitcoin?]

2009

11 January 2009 | Bitcoin Price: $0.0008

First ever Bitcoin Price Prediction

Hal Finney was the first person to ever receive a Bitcoin transaction from Satoshi Nakamoto. He is also believed to be the first person to make a long-term price prediction for Bitcoin, just a week after the network went live. Finney estimated that Bitcoin could reach $10 million per coin, a figure that must have sounded absurd at the time. His prediction actually ranged from $5 to $15 million, with $10 million as the middle value. He based this estimate on a simple calculation: assuming total global wealth in the hundreds of trillions of dollars and dividing that by the finite supply of Bitcoin that will ever be produced.

"As an amusing thought experiment, imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. With 20 million coins, that gives each coin a value of about $10 million." [Hal Finney - The Cryptography Mailing List]

Why Choose Us?

Our coaching stands apart from the rest, as we employ a deeply empathetic approach that allows us to meet you at your skill level.